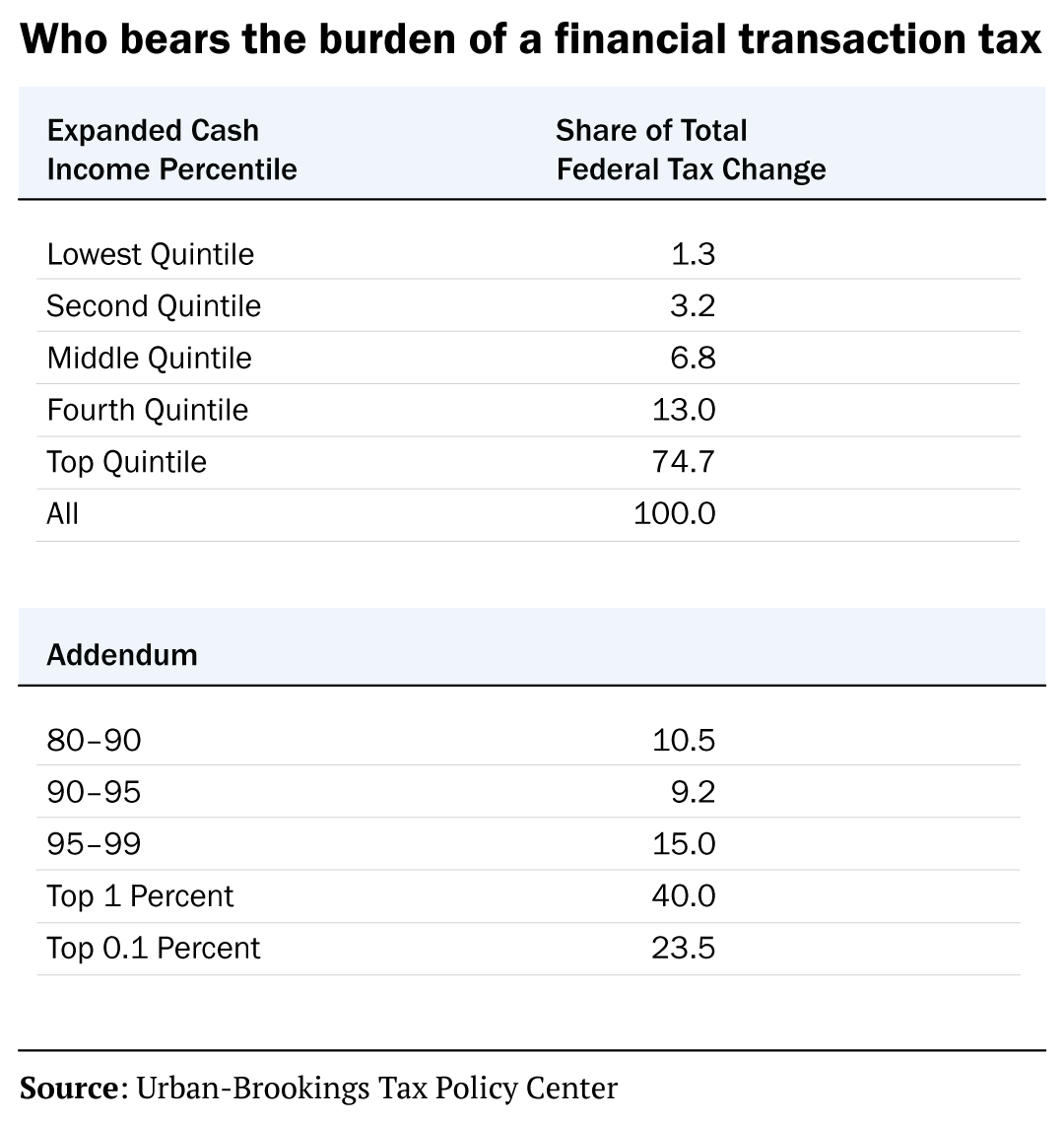

Since this is likely to be a relatively wealthy group of people, in this case, too, an FTT would reduce inequality.īoth of these scenarios are described further below. In this case, an FTT that reduces trades would actually create savings for investors and the costs would be borne by those who own financial institutions (as shareholders or partners) and those who work for them. Instead, it is engineered only to generate fees for financial institutions, as explained further on. However, the second scenario could come about because there is evidence that a portion of today’s trading in financial assets is not in the interest of investors. In this case, an FTT would reduce inequality because most financial assets are held by the wealthy. A tax on these trades and the resulting reduction in trades, therefore, creates a cost for investors. The first scenario assumes that trades of financial assets are in the interest of investors. In either scenario, an FTT would be a progressive tax.

In another possible scenario, some investors could save money and at least a portion of the tax would ultimately be borne by the owners and employees of financial institutions that carry out trades. In one scenario the costs would be passed on entirely to investors. Curbing InequalityĪn FTT would raise the costs of trading financial assets, resulting in fewer trades. How policymakers design the tax matters a great deal for its effectiveness and revenue impact. This, combined with the investments that could be financed with an FTT, could reduce income inequality and wealth inequality. The people most likely to bear this cost are disproportionately well-off. But because the volume of financial transactions is so vast, these proposals would nonetheless raise hundreds of billions of dollars over a decade, even accounting for the reduction in trades that would likely result. Most proposed FTTs would apply to trades at what appear to be very low rates, such as 0.5 percent, 0.1 percent, or much less.

#Financial transaction tax full#

A number of countries already have full or partial FTTs, and the idea of imposing a comprehensive, broad-based FTT on trades of most types of financial assets has become more attractive both in the U.S. Recently there has been renewed interest in such a tax on international financial transactions.A financial transaction tax (FTT) has the potential to curb inequality, reduce market inefficiencies, and raise hundreds of billions of dollars in revenue over the next decade.Īn FTT is a type of excise tax imposed on trades of financial assets, including stocks, bonds, and derivatives. 004 percent tax only on stock transfers to generate revenue to support the operations of the Securities and Excahnge Commission. had a financial transactions tax from 1914 to 1966 but then reduced it to a trivial. They are happy with a very small return on each tradeįinancial transactions taxes are in place in more than 15 countries. Today traders hold assets for a few hours, or even a few minutes. The modest tax could dampen volatility and encourage longer term investment.

In the 1970s, Nobel Prize winning economist James Tobin proposed a tax on international financial transactions. To slow down the speculative and destablizing flow of money, John Maynard Keynes proposed a small financial transaactions tax in 1930.

Money is a human invention and rules that control its dynamic are also a human invention. This delinking of money from place and productive investment is not the inevitable result of technological advances or economic evolution. We trade more than $100 worth of stock and bonds for every dollar raised for investment in new plant and equipment, a ratio almost four times greater than 30 years ago. The volume of currency trading is now some 50 times greater than the volume of trade in goods and services. In 1970 more than 95 percent of currency trades were for activities linked to what many call the “real economy” - investment, tourism, foreign aid, trade.

0 kommentar(er)

0 kommentar(er)